Opportunity Cost Is Calculated by Which of the Following

Finding the value of the best option that is not chosen. The opportunity cost of producing 1 Guava c.

Opportunity Cost Meaning Importance Calculation And More In 2022 Opportunity Cost Meant To Be Accounting And Finance

This can be cash weight or products.

. Opportunity cost is calculated by using the following formula O p p o r t u n i t y c o s t R F O R C O. How to Calculate Opportunity Costs. To calculate the marginal cost of producing more items divide the change in the total cost by the change in the quantity.

Opportunity Cost 50 70 -20. Enter your responses as a whole number. Consider the opportunity cost of a college education.

The opportunity cost of producing 1. Subtracting all costs from the total benefit. Which calculates opportunity cost.

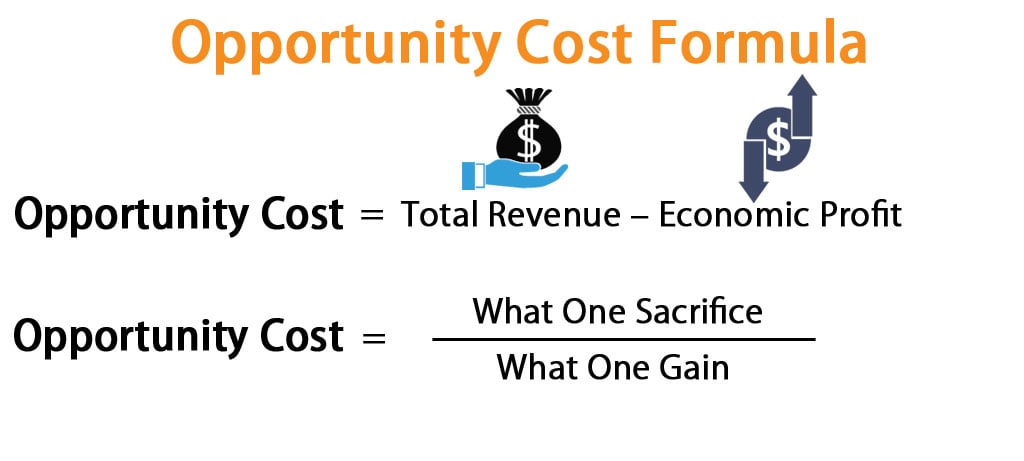

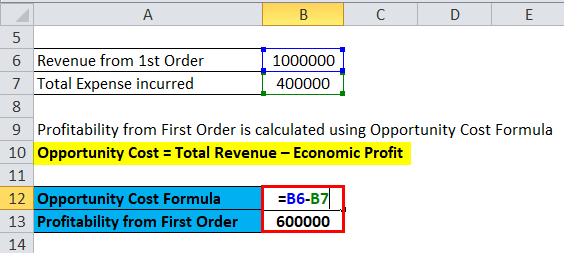

As the manufacturer has two different orders with diversified characteristics so we have to calculate the profit from both of the orders individually. Its important to understand exactly how the NPV formula works in Excel and the math behind it. This is easy to see while looking at the graph but opportunity cost can also be calculated simply by dividing the cost of what is given up by what is gained.

For example the opportunity cost of the burger is the cost of the burger divided by the cost of the bus ticket or latexfrac2000504latex The opportunity cost of a bus ticket is. In the business example given above your opportunity cost was 10000 because the formula was. 730 annual opportunity cost rate.

Opportunity cost 30000 X 2 50000. You will receive your score and answers at the end. Subtracting all costs from the total benefit.

The opportunity cost is the cost of the movie and the enjoyment of seeing it. When you choose rocky road the opportunity cost is the enjoyment of the strawberry. Choose an answer and hit next.

The opportunity cost of producing 1 TV d. The basic formula to calculate opportunity cost is simple. Guavas 100 Mangoes TVs a.

Calculate the opportunity cost based on the following information. Finding the value of the best option that is not chosen. The cost of tuition for out-of.

The opportunity cost of producing 1 TV d. This can be done during the decision-making process by estimating future returns. Such as 0 to 50 50 to 100 100 to 150 etc 2500 houses b.

Limitations of Opportunity Costs. Calculating opportunity cost How to calculate opportunity cost. Someone gives up going to see a movie to study for a test in order to get a good grade.

RCO Return on the chosen option. Future returns cannot be predicted accurately using. The following are the limitations of opportunity costs.

12000 investing 10000 new equipment 2000. This is illustrated in the following formula for calculating opportunity cost. With the same amount of resources Country A.

First Order INR 7500 16 100 1800. Opportunity Cost Return on Most Profitable Investment Choice - Return on Investment Chosen to Pursue. Opportunity cost The return of the option not chosen The return of the option chosen.

How to Calculate Opportunity Cost - Quiz Worksheet. Opportunity cost is calculated by which of the following. NPV F 1 rn where PV Present Value F Future payment cash flow r Discount rate n the number of periods in the future.

Return on best foregone option FO - return on chosen option CO opportunity cost The formula is simply the difference between what the expected returns are of each option. Evaluate cost by hour day week or year for each option. Lets look more closely at the way opportunity cost works in the real world.

Number of Economic Alternatives 3 skirt for 50 earrings for 70 and purse for 65 Desired Alternative 50 skirt Next Best Alternative 70 earrings Now applying the above mentioned opportunity cost formula. For this scenario you would calculate the opportunity cost by taking the amount of the most lucrative option investing and subtracting the chosen option new equipment. Opportunity cost is what you give up by not taking the choice that is second best.

Calculating the cost of time energy and sacrifice. 3 days of collection float. Calculating the cost of time energy and sacrifice.

Ask an expert Ask an expert done loading. How To Calculate Marginal Opportunity Cost. To calculate the opportunity cost compare each opportunity based on a similar unit of measurement.

Possible Output Combinations Output per month A B D F Missiles 50 100 150 200 250 Houses 100 90 75 55 30 The opportunity cost of increasing missile production by 50 is. RFO - RCO Opportunitycost RFORCO. The net average in-state tuition at a public four-year institution is 3120 once federal grants are applied.

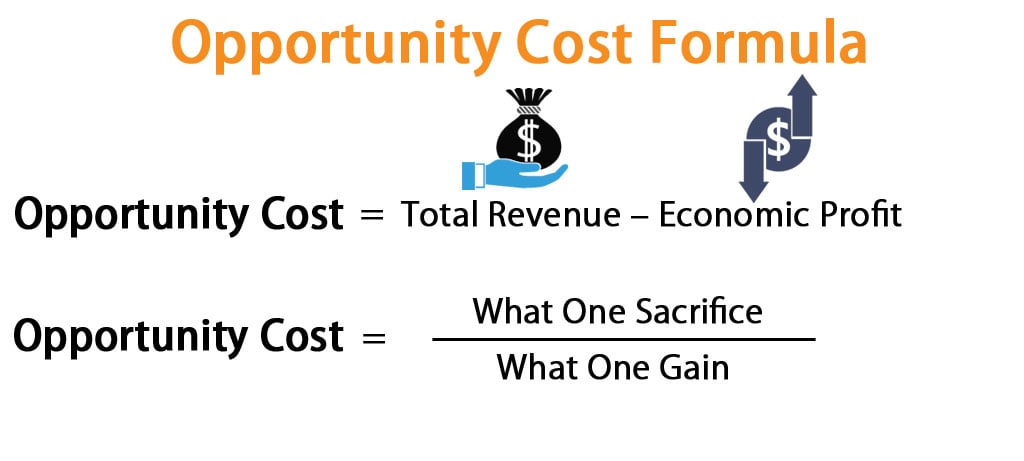

Opportunity cost is calculated by applying the following formula. Opportunity Cost Total Revenue Economic Profit. Using the bakers example lets assume that you currently produce 100 loaves every day at a unit cost of a 30-cents per loafJun 11 2018.

The opportunity cost of producing 1 Mango b. RFO Return on the next best-forsaken option. At the ice cream parlor you have to choose between rocky road and strawberry.

Group of answer choices. Profit from the First Order. Find out her opportunity cost if she buys the skirt.

The basic way to calculate your opportunity cost is to subtract the value of the option that you chose from the value of the best alternative that you missed out on. Find out the better option and the opportunity costs he misses. Calculate the appropriate opportunity costs given the following PPFS.

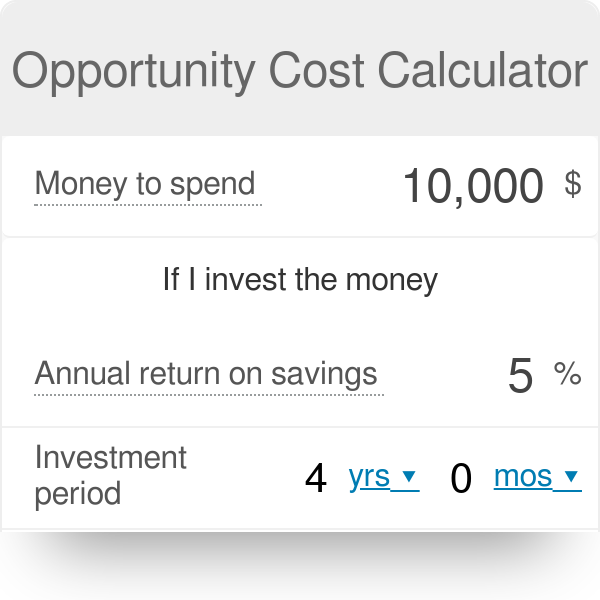

Adding the value of all lost opportunities. Use the following assumptions to calculate the opportunity cost of funds. However the following is a formula that some businesses use to calculate opportunity costs when possible.

Sunk Cost Opportunity Cost and Trade-Offs. The tuition is the most obvious cost. Alternatively the opportunity cost can be calculated with hindsight by comparing returns since the decision was made.

The opportunity cost of producing 1 Laptop Question. Opportunity Cost Return on investment for an option not chosen Return on investment for a chosen option. Opportunity costs can be calculated using the following formula.

The Opportunity Cost of College. An investor calculates the opportunity cost by comparing the returns of two options.

Opportunity Cost Definition Sunk Cost Explicit Implicit Cost

Difference Between Opportunity Cost And Trade Off

Calculating Opportunity Cost Youtube

Pin On Business Law Important Questions

Accounting For Financial Decision Making 1st Edition Ebook In 2022 Financial Decisions Financial Decision Making

Opportunity Cost Formula Calculator Excel Template

Opportunity Cost Definition Calculations Examples Video Lesson Transcript Study Com

Pin On Business Law Important Questions

What Is Minimum Efficiency Scale Definition And Explanation Scale Definition Basic Concepts Economies Of Scale

Return On Investment Roi Scheduled Via Http Www Tailwindapp Com Utm Source Pinterest Utm Medium Twpin Investing Financial Analysis Accounting Education

1 2 Opportunity Costs Sunk Costs Principles Of Microeconomics

How To Graph And Read The Production Possibilities Frontier Economics Lessons Economics Lessons College Teaching Economics

Opportunity Cost Formula Calculator Excel Template

How To Calculate Opportunity Cost For Business Decisions Brex

How To Calculate Opportunity Cost Youtube

Find Break Even Point Volume In 5 Steps From Costs And Revenues Analysis Graphing Good Essay

Calculated Task But Simple Financial Quotes Personal Finance Budget Money Skills

Http Caramenghitung Com Menghitung Net Present Value Html Investasi

Comments

Post a Comment